A man works in a cocoa plantation in Enchi June 17, 2014. Ghana's big budget and current account deficits have stripped the cedi of 45 percent of its value against the dollar since January. That means farmers in Ghana, who get a fixed price for the season from the country's cocoa marketing board, Cocobod, can get much more for their crop by smuggling it into Ivory Coast, where the sector is recovering strongly after a decade of civil conflict and political turmoil. (Photo by Thierry Gouegnon/Reuters)

Men work with cocoa beans in Enchi June 17, 2014. At a time when chocolate consumption is booming in new markets, particularly in Asia, Ghana's problems may jeopardize its ambitious plans to nearly double production to mitigate the resulting global supply shortfall. (Photo by Thierry Gouegnon/Reuters)

A worker sleeps in a cocoa warehouse in Dabisso June 18, 2014. “Every time the cedi devalues against the dollar, it reduces the capacity to buy fertilisers and inputs to help the farmers”, said a European analyst. “If you consider Ghana is going to produce 900,000 tonnes, about 21 or 22 percent of world demand, it's of enormous importance”. (Photo by Thierry Gouegnon/Reuters)

People work with cocoa beans in Enchi June 17, 2014. Picture taken June 17, 2014. Ghana emerged as a success story during the 2000s, when war, political instability and a disastrous liberalization brought Ivory Coast's cocoa sector to its knees. Ghana's output more than tripled from 340,000 tons in the 2001/02 season to a record 1,025,000 tons a decade later. Strict controls cemented its reputation as a producer of top quality beans, establishing a brand that fetches a premium. (Photo by Thierry Gouegnon/Reuters)

A member of Ghana's anti-smuggling task force treks through a cocoa plantation in Enchi, June 17, 2014. A combination of better management of forward sales, increasing world prices and improvements in quality allowed Cocobod to increase the amount it paid farmers from 900 cedis per ton in 2005 to 3,392 cedis ($989) per ton for the current season. (Photo by Thierry Gouegnon/Reuters)

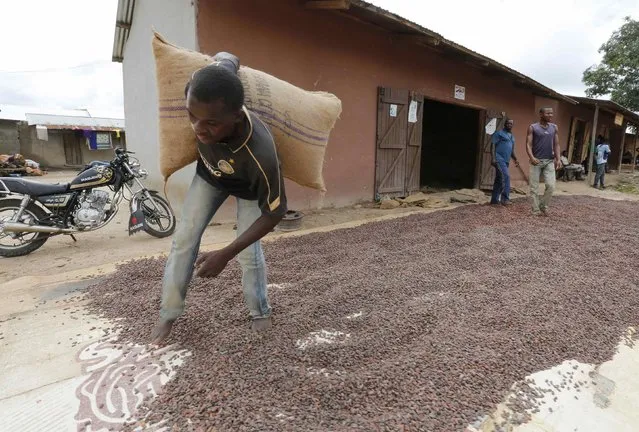

Men pour out cocoa beans to dry in Niable, at the border between Ivory Coast and Ghana, June 19, 2014. The twin deficits mounted and the government finally abandoned its struggle to prop up the currency. That also caused a spike in inflation, which was 15 percent year on year in June, hitting farmers' purchasing power. (Photo by Thierry Gouegnon/Reuters)

Members of Ghana's anti-smuggling task force walk at a plantation in Enchi, June 17, 2014. At the market in Karlo, a border town not far from Andrews Assum's cocoa plantation, a bag of rice that cost 75 cedis a year ago now sells for 120 cedis. “The market is very high, and the cedi is very low. You can't buy anything”, said the 35-year-old farmer. “We don't have enough money to continue our children's schooling”. (Photo by Thierry Gouegnon/Reuters)

A worker carries a cocoa bag at a warehouse in Dabisso June 18, 2014. Last season, after a brief 2011 civil conflict ended years of political turmoil, its new President Alassane Ouattara ushered in reforms that established a single marketing board, the Coffee and Cocoa Council (CCC), to manage the sector. It abandoned a system of spot sales and auctioned off the bulk of its crop in advance in order to set a guaranteed minimum price for farmers. In a single season it succeeded in stamping out a decade-long trafficking epidemic that saw a peak of around 200,000 tons of cocoa lost to smugglers in the 2010/11 season. (Photo by Thierry Gouegnon/Reuters)

Cocoa farmer Assum gestures at his warehouse in Dabisso June 18, 2014. A member of Ghana's anti-smuggling task force treks through a cocoa plantation in Enchi. While his team has had some success in stopping trucks, several of which are now impounded at the district police station, much of the cocoa smuggled out of Ghana is leaving the country on the heads of porters. “The government must try as much as possible to boost the price. That will be the only solution”, James said. “Other than that, we are only 15 here. We cannot cover all of the routes”. (Photo by Thierry Gouegnon/Reuters)

Men pour out cocoa beans to dry in Niable. At the October start of the 2013/14 season – the second under the new reform regime – the CCC raised its farmgate price so it was roughly equal to Cocobod's. Not for long. As the Ghanaian cedi plunged, Ivory Coast's CFA franc, a regional currency pegged to the euro, held stable. Today, in dollar terms, the Ivorian price is more than 55 percent higher. (Photo by Thierry Gouegnon/Reuters)

A man carries a cocoa bag while walking over cocoa beans left out to dry in Niable. Cocobod hopes to overtake Ivory Coast as the world's top producer, an ambitious target that requires it to double production from the sector, Ghana's third-largest export earner. “We know that's not going to happen soon. It's a long-term goal and not a race”, a senior Cocobod official told Reuters, asking not to be named. “We're confident of significantly raising output from the current levels”. (Photo by Thierry Gouegnon/Reuters)

A woman walks past men working with cocoa beans in Enchi. With the finance ministry forecasting a year-end budget deficit of 8.8 percent of gross domestic product, there will be a lot of budget gaps to close. Johannes Jansen, the World Bank's senior agricultural economist in Ghana, puts the windfall at hundreds of millions of dollars, helped by current high market prices, but he says little of that will find its way into the pockets of farmers. (Photo by Thierry Gouegnon/Reuters)

03 Aug 2014 07:17:00,

post received

0 comments